Bitcoin Just Hit an All-Time High... But Something Feels Off

Bitcoin just broke another all-time high. And sure, the charts look incredible, and the headlines are screaming bull market. But beneath the surface? There's something far more important happening. Something that could shape Bitcoin's next chapter in a way that most people aren't ready for.

Yes, the ETFs are pumping money in. Yes, more companies and even countries are stacking BTC. But at what cost?

This article breaks it all down. The upside. The risk. The long game.

Let’s dive in.

Chapter 1: The New Players — Corporations Join the Game

Back in 2020, Michael Saylor pulled off what looked like a Hail Mary. He took a tech firm with stagnant growth and threw its treasury into Bitcoin. Everyone thought he was crazy. Now? He’s a genius.

MicroStrategy didn't just hold BTC. It borrowed money to buy even more. It issued corporate bonds, secured debt, and used the cash to keep stacking.

Now, MetaPlanet is doing it. Trump Media is flirting with it. Nation-states are considering similar strategies.

These aren’t one-off moves. They’re signals.

And they tell us this: the financial system is waking up to Bitcoin, not as a fringe asset, but as a treasury reserve. A store of value. A financial weapon.

Here’s the beauty of it:

Corporate treasuries can borrow long-term at relatively low rates

They don’t face short-term liquidations the way margin traders do

They can structure debt for 3, 5, or even 10 years, giving them time to ride out BTC’s volatility

It’s the ultimate playbook for high-conviction investors with deep pockets.

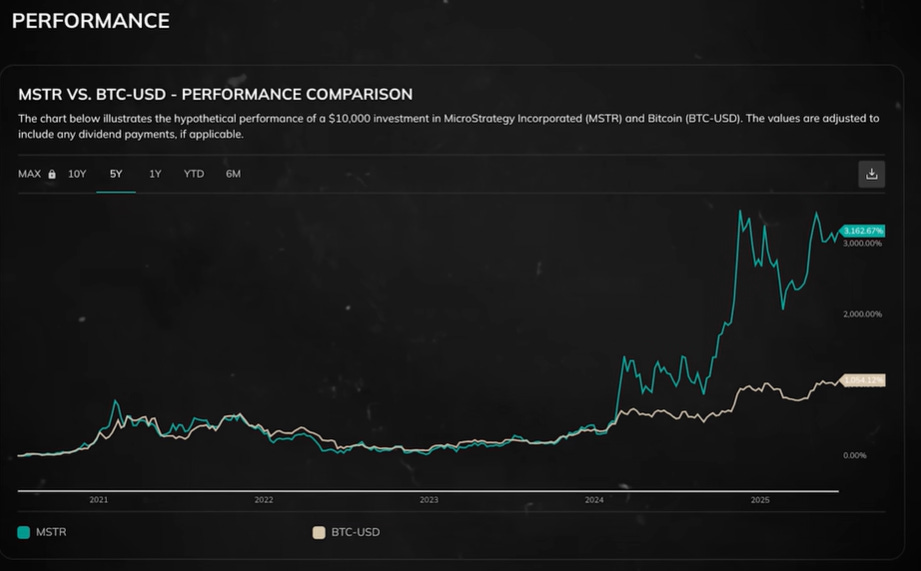

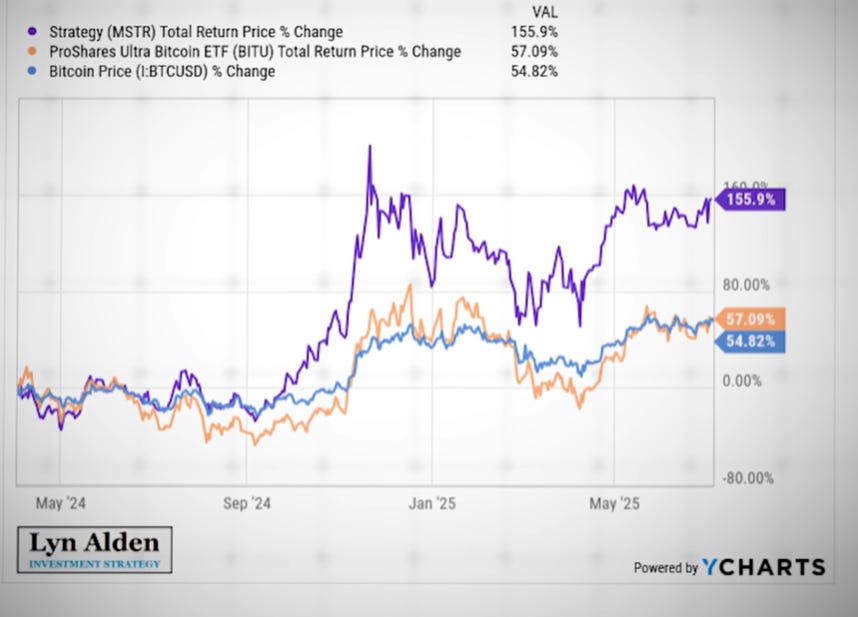

Chapter 2: Why Some Stocks Are Beating Bitcoin

Here’s a shocker:

Some Bitcoin-exposed stocks have outperformed Bitcoin itself.

How?

Because of two factors:

Smaller market caps — It takes less capital to move the price of a company like MicroStrategy than it does to move BTC directly

Leverage — These firms are borrowing to increase exposure. If Bitcoin moves 20%, their stock might move 40%

That’s why MSTR often leads BTC during bull runs. It’s like buying a Bitcoin ETF on steroids.

But it's not just MSTR. There are now dozens of public companies with BTC on their books. Some are miners. Others are holding companies. A few are issuing convertible debt instruments just to buy more Bitcoin.

And that gives investors new options:

Low-beta exposure through ETFs

High-beta exposure through treasury stocks

Ultra-high-beta exposure through leveraged products

It’s no longer just about buying Bitcoin. It’s about how you gain exposure.

Chapter 3: This Isn’t What Satoshi Had in Mind

Let’s take a step back.

Bitcoin was designed to be a decentralized, peer-to-peer currency. Not a Wall Street asset. Not a reserve for billion-dollar corporations. It was about financial sovereignty, censorship resistance, and opt-out from traditional finance.

So here’s the uncomfortable truth:

This institutional surge comes with strings attached.

Self-custody is fading — Most new investors access BTC via custodians, brokers, or ETFs

Control is concentrating — A handful of funds and firms now hold more BTC than millions of individuals combined

Leverage is rising — And we know how this ends if prices drop

In short: the Bitcoin network remains decentralized. But Bitcoin ownership is slowly centralizing.

And that’s a problem.

Chapter 4: The Fragility of Leverage

Corporate Bitcoin buying isn’t always funded with cash. It’s often financed with debt.

That means when BTC is rising, everything looks perfect. Stock prices soar. Convertible bonds trade well above par. Shareholders are happy.

But if BTC crashes?

The same leverage that supercharged returns becomes a noose. Firms may face:

Bond downgrades

Liquidity squeezes

Forced liquidations

This is where risk compounds.

If one major player dumps BTC to cover a margin call, that drop could trigger another firm’s liquidation threshold. Then another. And another.

This is how dominoes fall.

The scary part? Many of these leveraged BTC treasuries are opaque. You don’t know their liquidation levels. You don’t know their debt terms. But when the market turns, it turns fast.

Chapter 5: Is Bitcoin Becoming a Corporate Tool?

Some critics argue Bitcoin is being co-opted. That it's now a tool for corporate games, not personal freedom.

They point to the rise of "suitcoiners" — companies accumulating BTC through custodians, issuing debt, and promoting the asset to pump their stock.

They ask:

What happens if BlackRock ends up with a million BTC?

What if regulators force ETFs to freeze withdrawals?

What if access to BTC becomes gated behind KYC and surveillance?

These aren’t paranoid hypotheticals. They’re early warning signs.

Yes, Bitcoin is resistant to censorship. Yes, the protocol is sound. But if access becomes controlled, we lose the point.

That’s why education around self-custody is more important than ever.

Chapter 6: Situational vs. Ubiquitous Money

Lyn Alden uses a brilliant framework to explain Bitcoin’s status.

Right now, Bitcoin is situational money.

It shines in moments of crisis:

Hyperinflation in Argentina

Bank runs in Lebanon

Capital controls in Nigeria

In those cases, Bitcoin is freedom. It's escape. It's lifeboat money.

But it’s not yet ubiquitous money. That requires:

Price stability

Wage integration

Broad merchant acceptance

And Bitcoin’s volatility still makes that hard.

Nobody wants to get paid in BTC only to see it drop 30% by rent day.

So for now, most people treat it as a long-term investment. Not as a currency.

Chapter 7: Why This Is Still Bullish

Let’s not lose sight of the bigger picture.

Despite all these concerns, corporate and institutional adoption is incredibly bullish:

It adds credibility

It brings in new capital

It exposes millions to BTC without them needing to be crypto-native

And the more entities that hold BTC, the more normalized it becomes.

This normalization is key for long-term adoption.

Think about it:

In 2013, Bitcoin was for nerds

In 2017, it was for speculators

In 2021, it was for retail

In 2025, it’s for institutions

What comes next?

Sovereign adoption. Payrolls. Real-world spending.

We’re not there yet. But we’re getting closer every cycle.

Chapter 8: What Needs to Happen Next

To keep Bitcoin on the right track, here’s what needs to happen:

Promote self-custody

Educate investors about leverage risks

Support open-source Bitcoin infrastructure

Build non-custodial tools for real-world usage

Hold institutions accountable for bad practices

Bitcoin doesn't belong to Wall Street. It belongs to everyone.

But only if we fight for that.

Final Message

Bitcoin hitting an all-time high should be cause for celebration. But it's also a chance to pause.

We’re entering a new phase. One that could unlock the next trillion in market cap. But also one that could reintroduce the same centralized risks Bitcoin was created to solve.

It’s not either-or. It’s both.

So celebrate the ATH. Stack your sats. But don’t forget what made Bitcoin valuable in the first place.

Freedom. Ownership. Choice.

Let’s not lose that.

Stay curious,

The Daily Dollar