Bitcoin's Next Explosion Could Start in 24 Hours — Here’s What's Happening

Close your eyes and picture this: the biggest banks on Earth, trillion-dollar asset managers, and national treasuries across the globe aligning on a single asset class that was once laughed off as internet magic money.

That asset is Bitcoin.

And the shift is already underway. In July 2025, it’s about to hit a tipping point.

We’re not just talking about another "bull run." We’re talking about a reconfiguration of global capital flows, a systemic upgrade to the financial system, and a battle for monetary dominance playing out in real-time.

This article is your July playbook. It’s built for serious crypto investors who want to:

Understand the real forces driving price action (not the headlines)

Track institutional footprints

Front-run the next inflows

Align portfolios with where capital is actually going

If you’re looking for short-term noise, this isn’t for you.

But if you want the real alpha that will shape the next decade of wealth creation?

Keep reading.

Chapter 1: Macro Madness — Why July Could Be a Historic Inflection Point

The Debt Cliff Is Here

The US Treasury has to roll over more than $6 trillion in maturing debt in the next 3 months.

That’s over 20% of the total US debt load — and it’s hitting at a time when interest rates are over 5%.

This is a once-in-a-century mismatch between debt maturity and market rates. It will cost the US government hundreds of billions in new annual interest payments.

Trump knows it. That’s why he’s pushing for aggressive rate cuts — not to juice markets, but to reduce the cost of refinancing.

His quote? “I don’t think I need to extend [the tariff pause], but I could.”

That’s code for: I’m willing to pull policy levers to shift capital flows.

Global Central Banks Are Already Cutting

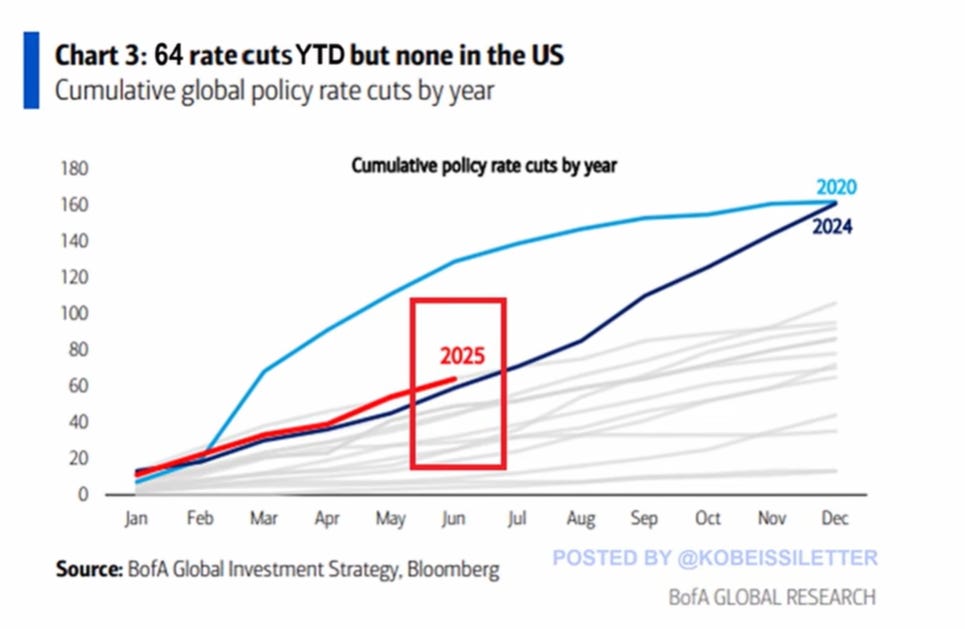

While Powell stalls, the rest of the world is already acting:

European Central Bank cut 25 bps

Bank of Canada just made its second cut this year

Reserve Bank of Australia, New Zealand, and Switzerland all moved

64 rate cuts globally in just the first half of 2025. That’s the most since 2020.

In a world where interest rates fall and debt piles rise, what happens?

The value of fiat drops.

Hard assets rise.

Bitcoin thrives.

China and BRICS Pressure

Meanwhile, China continues to build out its digital yuan. BRICS nations are deepening trade settlements outside the USD system. Russia and India are pushing for gold and CBDC-based trade.

This is the fragmentation of the global financial system in real-time.

And in that environment, Bitcoin doesn’t just look like a hedge.

It looks like a requirement.

Chapter 2: The Institutional Era Begins — With a Bitcoin Supply Shock

Bitcoin’s fixed supply is legendary. But what most people don’t understand is this:

Institutional Buy Targets Now Exceed New Issuance

Let’s do the math.

Post-halving, 3.125 BTC per block

~450 BTC/day = ~164,250 BTC/year

Now compare that with:

BlackRock + Fidelity ETFs: already buying >3,000 BTC/week

MicroStrategy: 226,331 BTC on the books

Sovereign entities (rumored in LATAM, Middle East) targeting BTC reserves

The supply is already spoken for.

And it’s not just about buying — it’s about removal from circulation.

These buyers:

Use custodial vaults (often offline)

Have 10+ year time horizons

Don’t trade, they accumulate

This creates an artificially shrinking float.

Add in:

Dormant wallets (65% of BTC hasn’t moved in over a year)

ETF structure keeping coins locked

Saylor literally saying, “I’m never selling — I’m going to die with my Bitcoin.”

That means every dip is getting bought faster. Every breakout happens with thinner liquidity. Volatility accelerates. And price discovery gets more violent.

Chapter 3: The Regulatory Switch Flips Green

US Clarity

For the first time ever, the US has two pro-crypto bills backed by both parties:

The Clarity Act — separates commodities (Bitcoin, ETH) from securities (pre-mines, ICOs)

The Genius Act — provides clear rules for exchanges, stablecoins, and KYC protocols

What this does:

Creates legal certainty for ETF issuers

Unlocks institutional mandates (pensions, endowments)

Paves way for traditional brokers to offer BTC/ETH directly

Trump supports both. And yes, he's said it publicly:

“Bitcoin is a great thing for our country. It takes pressure off the dollar.”

This is not 2017 anymore. The government isn’t trying to kill crypto. It’s onboarding it.

Global Ripple Effects

TF Securities got a crypto license in Hong Kong — stock soared 30%

Brazil’s central bank just approved tokenized bonds on-chain

Swiss banks now offer staking-as-a-service for ETH and DOT

This isn’t isolated. It’s coordinated. A regulatory arms race is happening.

And capital will flow to the jurisdictions that act first.

The US knows this. And that’s why these bills are moving fast.

Chapter 4: The Altcoin Shake-Up — New Sector Leaders Are Emerging

Memecoin mania is fading. Volume on PumFund is down 80%+ from April.

So where is the money going?

Lending Protocols

Uler, Syrup, Radiant — seeing >20% monthly TVL growth

Real yields. Transparent treasuries. Lending to known entities.

These protocols are becoming DeFi banks. And institutions are taking notes.

L1 Sector Realignment

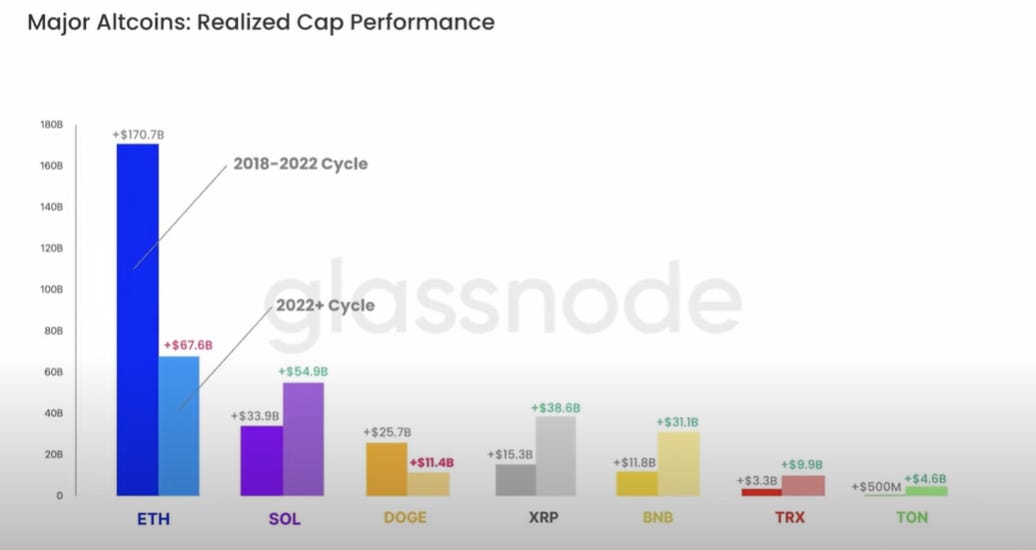

Ethereum still leads, but its growth is slowing

Solana’s realized cap now 54B (vs ETH’s 67B)

Avalanche, Base, Sei gaining user share fast

This isn’t just a narrative shift. It’s a usage shift.

Infrastructure and Middleware

Chainlink: adding real-world data to RWAs

Graph: indexing layer for AI x crypto

EigenLayer: restaking opens new markets for LSTs

These tools power real apps. And capital is noticing.

On-Chain Fee Growth

BaseChain: $1B+ in cumulative fees

Circle: record USDC settlement growth

Aerodrome: top 3 DEX by fee revenue

The thesis is simple:

Revenue is the new narrative.

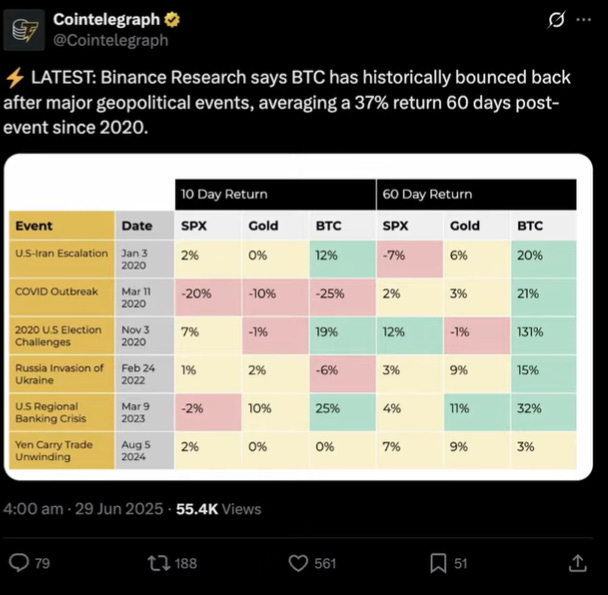

Chapter 5: Seasonality + Historical Patterns

Post-Halving Rally Blueprint

Here’s what happened in every post-halving year (2013, 2017, 2021):

Q2: Quiet green build-up

Q3: Acceleration with 30–50% gains

Q4: Blow-off top or major breakout

We’re repeating the pattern.

Q2 2025:

BTC +31%

ETH +37%

Every post-halving July and August has closed green.

We’re heading into a zone of historical strength — right when macro, policy, and supply all converge.

Don’t sleep on this data.

Chapter 6: Front-Running the Next Wave — The Investor Playbook

Step 1: Stack Bitcoin — Your Base Layer

BTC is still your asymmetric hedge. Don’t overthink it. Stack consistently. Hold long-term. Use cold storage.

Target: 30–60% of your crypto stack.

Step 2: Add Real Revenue Projects

Use Token Terminal and DeFiLlama to filter protocols by real earnings.

Look for:

Protocols with positive net income

Sustainable tokenomics (low emissions)

Strong team and traction

Examples: Uniswap, Aerodrome, Syrup, MakerDAO

Step 3: Add Infrastructure Leverage

Use altcoins that have:

Institutional traction

Strong partnerships

Real protocol usage

Examples: LINK, GRT, INJ, AVAX, STX

Step 4: Track Flows + On-Chain Activity

Use Glassnode for realized cap and dormancy

Watch ETF net inflows on SoSoValue or Farside

Monitor Base and Solana fee growth

Step 5: Align with Regulation

Prefer tokens compliant in US, HK, EU

Watch project audits and licenses

Step 6: Scale In Over July

Use DCA with acceleration into macro events (July 9 tariff deadline, September regulation window)

Hold 10–20% cash for sudden volatility

Final Thoughts: This Is the Beginning of Bitcoin's Institutional Cycle

The 2020s will be remembered as the decade when the financial system fractured.

And in that void, Bitcoin went from joke to juggernaut.

Right now:

Institutions are buying

Regulation is unlocking

Supply is disappearing

And most of retail still doesn’t see it.

You do.

And that’s your edge.

Stay sharp. Stack sats. Watch capital. Follow regulation.

This is your moment.

Circle — the company behind USDC, the second largest stablecoin on the planet — is trading at valuations near 100 times EBITDA. That’s a staggering number. But what’s more staggering is what sits underneath Circle: Ethereum.

I hope your predictions are CORRECT; Because my bitcoin has dropped value consecutively in the last 3 days!