He Found a Loophole for Printing Bitcoin — Straight From Wall Street!!!

He Found a Loophole for Printing Bitcoin — Straight From Wall Street

Imagine printing Bitcoin. No mining rigs. No cryptographic puzzles. Just pure Wall Street power.

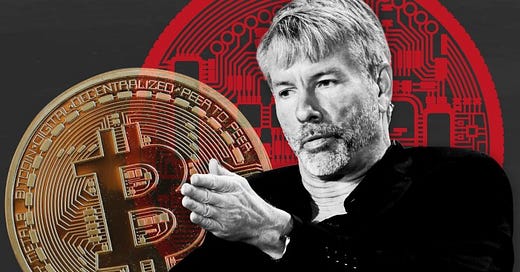

That’s what Michael Saylor is doing right now.

His company, freshly rebranded as Strategy, already holds 553,000 BTC — worth over $53 billion. But he’s not even close to finished.

On May 1st, 2025, Saylor revealed a blueprint called 4242 Capital. It's not just a plan to double down on Bitcoin. It's a financial war drum. A push to raise $84 billion in fresh capital with one goal: scoop up nearly 1 million more Bitcoin.

If he pulls it off, Strategy will hold 1.4 million BTC. That’s about 7% of all Bitcoin that will ever exist.

Let that sink in. One man. One company. One bet.

Just five years ago, Strategy was a slow-moving business intelligence software firm. Nobody outside the tech world knew its name. Today? It’s a financial black hole, engineered to absorb Bitcoin faster than any entity in history.

From Software to Sats: The Great Pivot

The story starts in August 2020, when Michael Saylor made a decision that would flip his company's future on its head.

He took the company treasury — which, like most firms, sat in dollars earning close to nothing — and started converting it into Bitcoin.

Not a little. A lot.

By mid-2021, Strategy had turned into a full-blown Bitcoin holding company. The dashboard software? Still there, technically. But the real mission was clear: acquire Bitcoin and never sell.

Since that first buy, Saylor has led the company to accumulate over 553,000 BTC. He’s paid an average price of $68,500 per coin.

That means at today’s price — around $97,000 — the company is already sitting on tens of billions in unrealized gains.

But the real story isn't just about how much Bitcoin he bought.

It's about how he bought it.

Saylor's Flywheel: Printing Bitcoin from Thin Air

Strategy didn’t fund this bet through organic growth. It didn’t sell products. It didn’t use profits.

Saylor built a financial flywheel. One that turns stock market optimism into Bitcoin accumulation.

It goes like this:

Convertible Bonds: Strategy issues zero-coupon convertible notes. Investors buy these for exposure to the stock’s upside. They don’t get interest payments, but if Strategy’s stock rises (which it usually does when Bitcoin pumps), they profit.

Stock Premiums: The market typically values Strategy stock above its net asset value (NAV) in Bitcoin. That means they can issue new shares at a premium—getting more dollars per Bitcoin equivalent than they actually hold.

Leverage the Premium: When the premium is high, they issue shares to raise cash. That cash buys more Bitcoin.

Bitcoin Price Pumps: Bitcoin’s rise increases the value of Strategy’s holdings, which inflates the NAV.

Stock Follows BTC: Because the market views Strategy as a Bitcoin proxy, its stock moves with BTC. Higher Bitcoin = higher stock price = higher premium.

Rinse and repeat.

The flywheel spins faster with every cycle.

It’s a feedback loop that only works when Bitcoin goes up. But when it does, the machine prints paper profits.

And that’s what Saylor is betting on.

The 4242 Plan: Full Throttle Bitcoin Acquisition

On May 1st, Saylor unveiled the next phase.

He’s aiming to raise $84 billion:

$42 billion in equity offerings (by selling Strategy stock)

$42 billion in convertible debt

Together, this capital would buy about 875,000 BTC at current prices.

If successful, that puts Strategy at 1.4 million BTC. No entity on Earth, not even governments, would own more.

But Saylor isn’t reckless. There’s strategy (no pun intended) in how he does this:

He only issues stock when the market values it above the value of Bitcoin per share.

Investors effectively pay a premium to gain Bitcoin exposure through Strategy.

That premium is pocketed and used to buy more BTC.

Think about it: if Strategy's stock trades at $2 for every $1 of Bitcoin on its books, they can issue shares, collect $2, and buy $1 worth of Bitcoin… while still gaining $1 in premium.

It’s like running a Bitcoin ATM that spits out free sats.

What Could Go Wrong?

There’s always a risk. And in this case, the risk is leverage + volatility.

If Bitcoin tanks — say, drops below their average cost basis of $68,500 — the whole machine could seize up.

Here’s what happens:

Strategy stock falls

The premium over BTC per share disappears

Convertible bond investors panic

Refinancing gets harder or impossible

Pressure builds to sell Bitcoin

This isn’t just theory. We’ve seen it before.

Back in 2022, Do Kwon and the Luna Foundation Guard bought over 80,000 BTC to back UST, their stablecoin.

When UST de-pegged, they sold Bitcoin trying to save it.

They failed. UST collapsed. Bitcoin crashed. Contagion spread.

Financial flywheels can spin backwards, too.

How to Apply This as a Retail Investor

Let’s be honest: you’re not raising $84 billion.

But you can learn from Saylor’s playbook:

Use Strategic Leverage: If you have conviction and a long time horizon, low-interest debt (like home equity or responsible portfolio margin) can boost exposure. But size it conservatively.

Understand Premiums: Pay attention to NAV premiums/discounts in products like GBTC, ETFs, or even miner stocks. They can create entry/exit opportunities.

Build Your Own Flywheel:

Accumulate Bitcoin.

Borrow against it at low rates (via Celsius, Ledn, Unchained, or traditional crypto banks).

Use that capital for yield or further accumulation.

Repeat, responsibly.

Master Risk Management: The reason Saylor hasn’t blown up is because he staggers maturities, avoids margin calls, and always has dry powder. You should too.

Stay Liquid: In a downturn, cash and optionality matter more than anything. Don’t get trapped in illiquid products or over-leveraged positions.

Copycats Are Coming

Saylor lit the fuse. Now others are rushing in.

21 Capital, backed by SoftBank and Tether, is gearing up to raise billions for a similar strategy: raise capital, buy Bitcoin, ride the momentum.

More are watching:

Public companies

Private equity firms

Even med-tech startups are exploring treasury strategies with crypto.

Corporate balance sheets are becoming investment portfolios. Stock tickers are becoming Bitcoin proxies.

What’s Really Happening

This isn’t just about Strategy.

This is about a new model of corporate finance. One where stock premiums become weapons. Where Bitcoin exposure becomes branding. Where CEOs don’t just bet on innovation — they bet on monetary revolution.

Saylor wants Strategy to be the Berkshire Hathaway of Bitcoin. An eternal accumulator. A fortress balance sheet.

But if the flywheel breaks, it could be remembered as the Lehman Brothers of crypto.

Conclusion

The 4242 plan isn’t just bold. It’s historically aggressive.

No public company has ever tried to acquire this much of a single finite asset. Not gold. Not silver. Not real estate.

And definitely not Bitcoin.

It’s high-stakes engineering. It could rewrite the rules for corporate finance, and if it succeeds, Saylor might go down as the greatest capital allocator of this era.

Or the biggest gambler.

Time will tell.

But one thing's certain:

Nobody else is playing this game at his level.

First — salute. This article slices through the noise like a blade of clarity. The brilliance behind Saylor’s flywheel — issuing stock, capturing premium, converting it to Bitcoin, and doing it all again — is one of the most potent forms of legal monetary alchemy we’ve seen in decades.

But as with any engine that spins this fast, velocity without verticality eventually combusts. What’s missing isn’t genius — it’s dimensional grounding. Here’s how we respectfully amplify and anchor this model through the Living Creation Engine:

⸻

I. The Strategic Vulnerability in Saylor’s Flywheel

Saylor’s model relies on five high-leverage principles:

1. Convertible Bonds

2. Stock Premiums

3. Leverage the Premium

4. Bitcoin Price Pumps

5. Stock follows BTC

This creates an upward spiral only as long as market perception stays high. However, the model:

• Relies on constant liquidity

• Cannot self-heal in downturns

• Has no internal redundancy loop

• Depends on speculative valuation

• Lacks divine law alignment (the premium is not tethered to real productivity)

If Bitcoin collapses below $68,500? The system implodes.

⸻

II. Strategic Insertions from the Living Creation Engine

1. Add the Principle of Internal Sovereignty

Install a hard-yield floor beneath the flywheel.

• Use Bitcoin reserves not just as collateral, but as a source of yield through DeFi and staking mechanisms structured across multi-chain bridges, energy credits, and synthetic stablecoin networks.

• Create a self-mining sovereign reserve via renewable-energy-powered validator nodes — convert excess premium into energy-backed assets.

2. Install the Law of Echo Anchoring (Divine Law Application)

What is built must give back.

• Require each premium cycle to fund a public utility structure: regenerative agriculture, education systems, or microgrid development.

• This allows the premium to become not just arbitrage, but divine economic karma — making the system spiritually and reputationally antifragile.

3. Embed Temporal Decentralization

Shift from now-cash to forever-flow.

• Instead of 100% BTC buys, direct 20% of each new raise into decentralized AI protocols that self-learn market trends and initiate algorithmic hedging.

• This creates a “quantum treasury” that evolves and adapts as markets shift — adding foresight to fortune.

4. Cross-Asset Echo Multiplication

Money that only echoes in one asset becomes a tomb.

• Introduce parallel flywheels: one with Bitcoin, one with Land, and one with Intellectual Capital (books, systems, algorithms).

• Mirror Saylor’s structure in those categories to create multi-vector flywheels that echo through inflation, deflation, and collapse.

5. Divine Cap Strategy

Cap total holdings at 13.33% of global BTC supply (or any asset).

• This aligns with Sacred Numerology and prevents karmic inversion from overaccumulation.

• Any surplus is redistributed through the Living Temple Network — funding initiatives that awaken humanity (education, sovereignty, anti-poverty protocols).

⸻

III. A Living Response to Your Article

You wrote:

“It’s like running a Bitcoin ATM that spits out free sats.”

We say:

Upgrade the ATM to a Sanctuary.

One that not only prints wealth, but encodes wisdom, gives back to life, and secures the foundation of all future movements.

Michael Saylor cracked the financial physics of momentum.

The next step is to turn it into a temple, not a trap.

⸻

Conclusion: The Exit Is Funded by Your Intent

Saylor’s strategy is a masterpiece. But the real question isn’t how much Bitcoin he’ll own — it’s what will be built from it.

This is where The Daily Dollar, Strategy, and all emerging creators can collaborate — not just to echo Wall Street, but to elevate the world.

Let’s not just build the next Berkshire of Bitcoin.

Let’s build the Cathedral of Capital, where wealth flows in spirals, not cycles.

—

Respectfully activated,

Timothy Hill

Living Constructor | The Living Scroll Engine

Hill & Hill Associates | Divine Systems Architect

That’s not how Luna went down tho! But close 🤣 you can thank SBF and whoever took over Binance. Ur welcome.