What if I told you the bull run hasn’t even started?

You’d probably roll your eyes and say, “Dude, what are you even on about?”

But I’m dead serious.

This isn’t hopium. This is a theory grounded in macro data, economic cycles, and some on-chain breadcrumbs that most people are flat-out ignoring.

It’s not just about charts and candles. It’s about understanding where we are in the big picture. And once you do, you’ll realize—this rally? It might be the opening act, not the finale.

Let’s get into it.

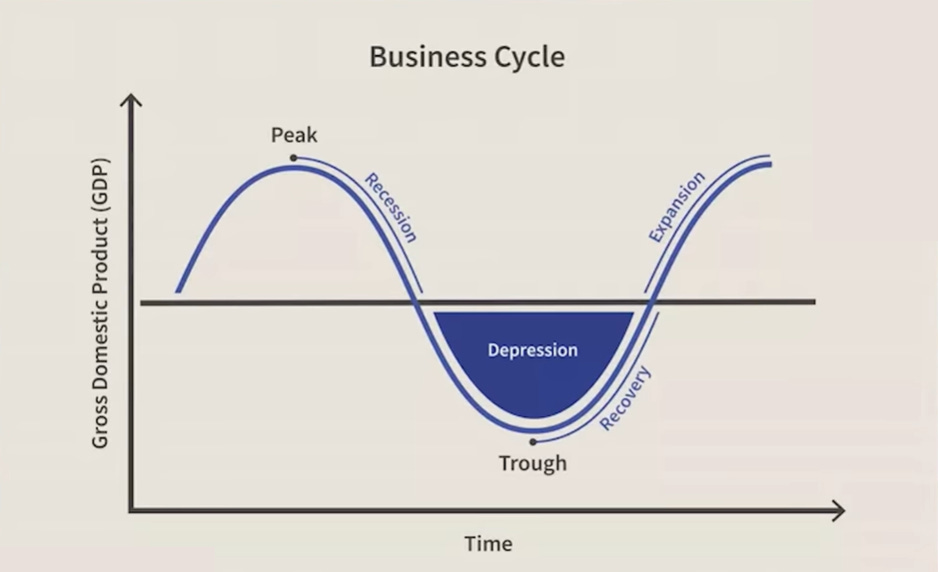

We’re Not at the Peak. We’re at the Bottom of a Massive Cycle

Here’s the core of the theory: Bitcoin doesn’t top until the economy does.

And based on what we’re seeing, the economy is just getting started.

No matter what the headlines say, we never had a real, acknowledged recession in 2022, 2023, or even 2024. Sure, there was pain. Layoffs. Tight money. But they refused to label it.

The media kept saying the soft landing was a miracle. But the reality? We went through a rolling recession. It just didn’t all hit at once. Housing took a hit. Tech got smashed. Consumers pulled back. But it wasn’t a synchronized crash.

And that’s exactly why they never rang the alarm bells.

But here’s what makes this theory worth paying attention to — the signs of a new cycle are popping up everywhere.

Not just in price charts. But in credit markets. In bond yields. In junk bond issuances. In IPOs. In GDP numbers.

Most people think we’re late in the cycle. I think we’re early.

Credit Markets Don’t Lie

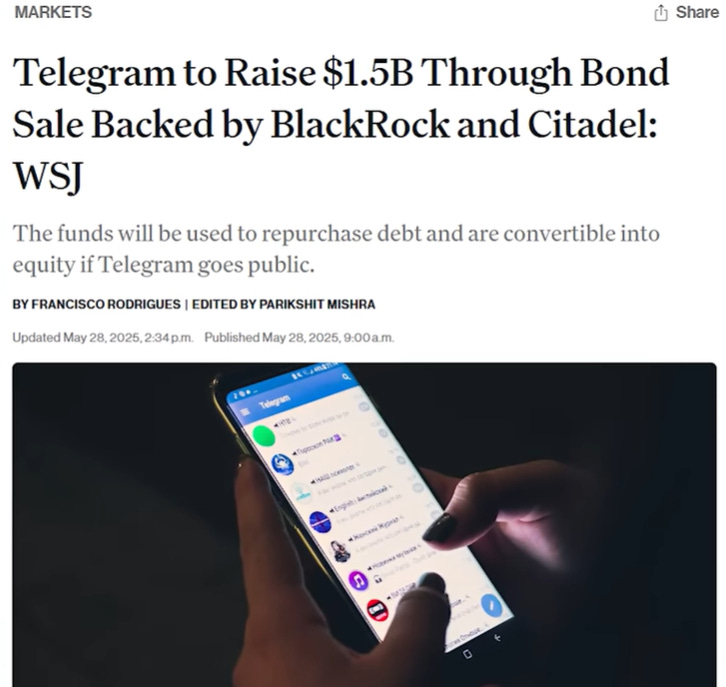

One of the best leading indicators? Junk bonds.

When investors start buying up debt from risky companies, they’re signaling one thing: risk appetite is back.

You don’t throw money into a 9% yield from a company that might default unless you think the economy’s going to grow.

Case in point — Telegram. They’re raising $1.5 billion. At 9%. And there’s no shortage of buyers.

This isn’t what happens when the market’s scared. This is what happens when people are getting ready for a run.

Inflation Is Cooling and Oil Is Cheap

For the last couple years, inflation has been public enemy #1.

But now? It’s basically dead.

April inflation numbers came in at 2.1%. The Fed’s target is 2%. We’re already there.

Oil is down too — sitting under $65. That’s almost half of what it was when the Ukraine war began. Trump said it best — cut oil prices, you cut inflation.

And that’s exactly what’s happening.

GDP Is Going Bananas

The Atlanta Fed just dropped a bomb: they’re projecting 4.6% GDP growth for Q2.

Let me say that again: 4.6%. That’s insane.

Especially when you remember Q1 was negative.

So what the hell happened?

Simple. We hit the trough. The cycle bottomed. And now the rubber band is snapping back.

Risk Assets Are Getting Frothy (But Not Euphoric Yet)

Bitcoin just blew through $110K. The S&P 500 is up 10% year-over-year.

Tech IPOs are starting to show signs of life again. That market was dead since 2022.

We’re not in a mania phase. Not even close. But things are warming up.

That’s exactly what you’d expect if we were entering a new expansion cycle.

And if that’s true — Bitcoin isn’t late. It’s early.

The $7 Trillion Time Bomb

Right now, there’s over $7 trillion just sitting in money market funds.

That’s $7T in cash. Waiting. Watching. Earning 4-5% while the economy figures itself out.

But if rates drop — and they will — that money will start looking for a new home.

Doesn’t take much. If just 5% of that $7T flows into Bitcoin or ETFs or even altcoins...

We’re talking billions in new demand. Slamming into a fixed supply.

That’s how supply shocks happen.

And that's what triggers the "oh my god why didn’t I buy earlier" panic FOMO.

The $250K Target Isn’t Just Meme Math

I’ve been saying $250K for over a year now. People laughed when I said it at $30K. They're not laughing as much now.

CryptoCon’s Fibonacci Bollinger Bands are pointing to a top between $128K and $250K.

Vaneck, Fundstrat, Standard Chartered — all calling for $180K to $250K.

This isn’t fringe anymore. It’s becoming consensus.

And it lines up with everything we’re seeing:

Global M2 is rising

Institutional adoption is accelerating

ETF demand is climbing

And now altcoin treasuries are becoming a real thing. Solana. XRP. ETH. They’re all getting added to balance sheets.

This is bigger than just Bitcoin.

None of the Top Signals Have Flashed Yet

Here’s what’s wild:

The Pi Cycle Top? Silent.

PE ratios? Not stretched.

Coinbase? Not even in the top 10 apps.

We’re not in peak euphoria.

We’re not even close.

There’s still disbelief.

There’s still fear.

People are still calling for a double top.

That’s not how bull markets end.

That’s how they begin.

This Is the Time to Lock In

Look — nothing moves up in a straight line. You know this. I know this.

But what matters is the direction of the cycle.

And right now? All signs point to up.

If this really is the start of the new expansion phase, then Bitcoin isn’t just going to break new highs...

It’s going to make new believers.

And if it does what it’s done in every other post-recession cycle? You’ll wish you had bought more, not less.

Now’s not the time to fade this.

Now’s the time to zoom out, stack smart, and be ready.

Final Thought

Most people are going to sleepwalk through the next part of this cycle.

They’ll sell too early. Or they’ll wait for confirmation. Or they’ll miss it completely.

Don’t be that person.

Look at the data. Look at the cycles.

The bull run hasn’t even started.

Stay sharp,

Abhaya

Founder, The Daily Dollar

I believe so, too, and it could last a long time. I have a term for this that I've coined. Not sure it's exactly how you've described but it feels like it aligns with your presentation.