This Bitcoin Report Will Break the Internet! - $5M BTC?

This Bitcoin Report Will Break the Internet - $5M BTC?

There’s a new peer-reviewed study making the rounds that says Bitcoin could hit $1 million by 2027—and $5 million by 2031.

That’s not a typo.

It’s a 48-page deep dive with real math, real models, and real scenarios. But here’s the thing—most people reading it won’t do anything with it. They’ll nod, maybe tweet about it, and then go back to scrolling.

We’re not doing that today!!

GET 75% OFF A PAID SUBSCRIPTION TO TheDailyDollar!!!! - Limited Time Offer!

You won’t just get the forecast. You’ll learn how to actually invest based on it.

This isn’t trading advice. This is about building a portfolio that survives volatility, captures upside, and positions you for the long game—if the math plays out.

First: Why This Study Matters (More Than the Others)

Most Bitcoin models are built on historical data and basic assumptions: stock-to-flow, power laws, energy models. But they all miss one thing—sovereign and institutional demand.

This new study bakes that in. It’s based on daily exchange withdrawals—specifically, how much BTC is leaving public markets and being locked away.

1,000 BTC/day withdrawn → $2 million BTC by 2027

2,000 BTC/day → $4.5 million BTC by 2031

Right now? We’re seeing 7,000 BTC per day in outflows.

That’s not a forecast. That’s real data.

And here’s what it means:

Supply is collapsing. Demand is institutional. This isn’t a cycle—it’s a structural shift.

So the question isn’t "what if Bitcoin hits $5 million?" It’s: "How do you invest for it now, before everyone else catches up?"

How to Invest for a $5 Million BTC

This is where most people mess up. They buy too late, chase pumps, sell early, or overcomplicate it with 50 altcoins.

Let’s cut through the noise.

1. Build a Long-Term Bitcoin Core Position

The base of your portfolio should be BTC you never plan to sell. Not for years. Maybe ever.

Use cold storage.

Don’t stake it.

Don’t trade it.

Think of it like buying real estate in Manhattan in the 1800s. You don’t flip it—you pass it down.

How much? That’s up to you. But here’s a starting point: Buy enough that it matters—but not so much that volatility keeps you up at night.

2. Set Automated Buys (DCA)

Don’t try to time the market.

Set a weekly or monthly buy. Let it run for years. If BTC is going where this study says, your job isn’t to be perfect—it’s to be consistent.

DCA removes emotion. It turns price dips into opportunities. And over time, it adds up.

Tools: Swan, River, Strike, Amber—pick one that fits your region and stick with it.

3. Use a Bitcoin-Only Retirement Account (Where Possible)

In the US? Look into Bitcoin IRAs or self-directed retirement accounts that let you hold BTC tax-deferred.

Australia? SMSFs can hold BTC with proper custody.

This lets you compound for decades without triggering taxes on every move.

The key is self-custody. Not paper BTC, not ETFs—actual Bitcoin.

4. Front-Run Sovereign Accumulation

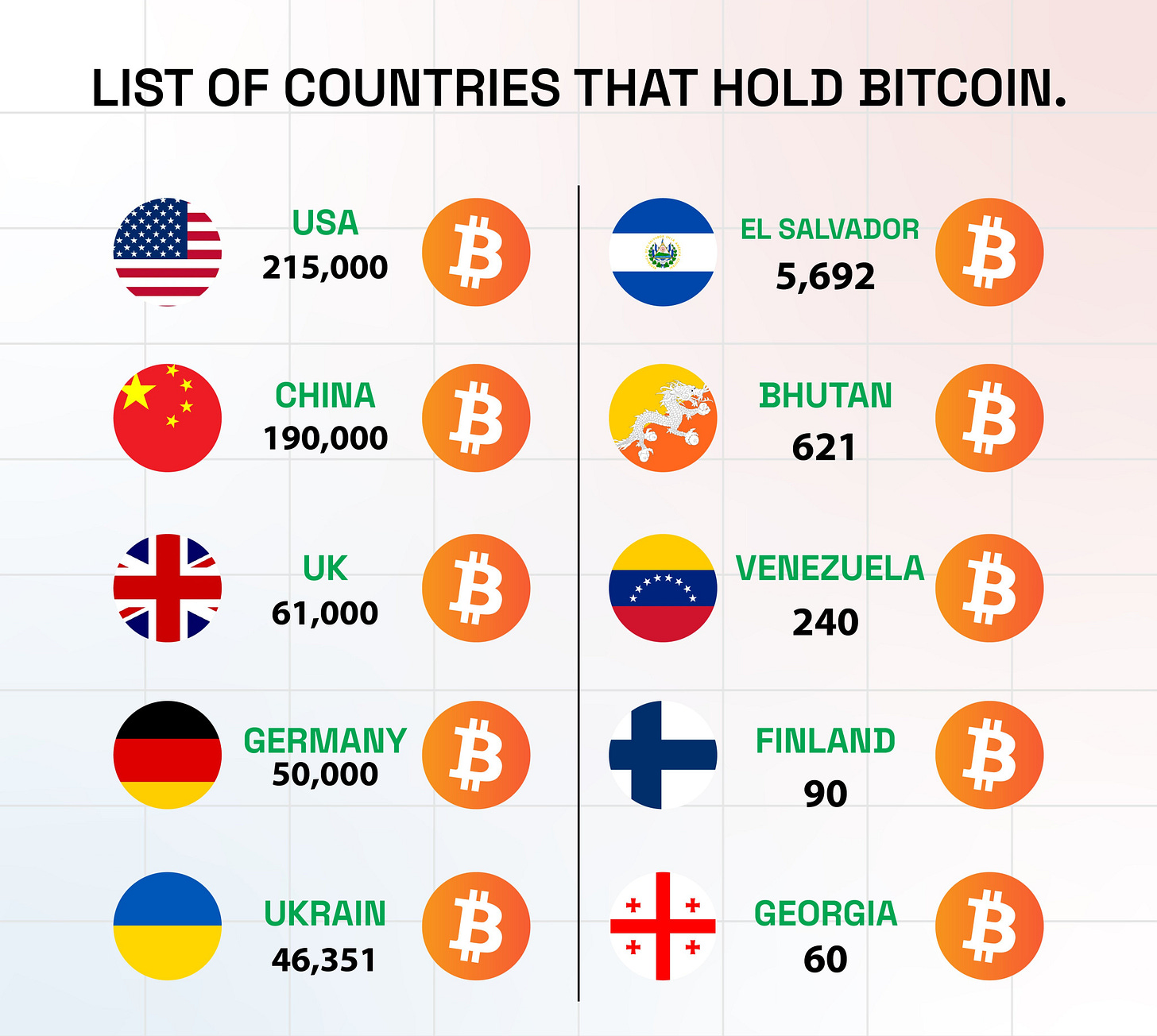

We already know MicroStrategy is buying. Now we’ve got RFK talking about a US reserve of 4 million BTC. Cynthia Lummis pushing for 1 million. The conversation has shifted from fringe to federal.

Once these buyers step in with real firepower, it’s game over for retail accumulation.

That’s why the play is to front-run them. Accumulate before the mandates. Before the reserves. Before the nation-state FOMO.

This study shows there’s not enough BTC on exchanges for even a handful of large players to build serious positions without driving price hyperbolic.

Don’t Make These Mistakes

Let’s be real. Even if Bitcoin hits $5 million, not everyone holding it will win.

Here’s what to avoid:

Overleveraging: If you borrow to buy and get liquidated, you’re out before the real move starts.

Altcoin distractions: Most coins won’t keep up. Some might outperform temporarily, but they bring risk that could wreck your entire strategy.

Selling too early: Don’t treat Bitcoin like a meme coin. Set timelines in years, not months.

Chasing yield on your core BTC: There’s no such thing as free yield. Every lending platform comes with risk. Don’t gamble your core stack.

The math is out. The timeline is real. And the average person still doesn’t get it.

Don’t be average.

Start stacking a position you’re proud of. Not because it’s trending, but because you understand what’s coming.

If the world moves to a Bitcoin standard, this will be the greatest transfer of wealth we ever witness.

Most people will miss it.

You don’t have to.

Want high-signal investing breakdowns like this every week?

Join The Daily Dollar and stay 10 steps ahead of the herd.

Paid subscribers get exclusive investment deep dives, execution plans, and research breakdowns that actually teach you how to invest—not just hype you up.