This Is About to Trigger Bitcoin’s Next Big Rally

This Is About to Trigger Bitcoin’s Next Big Rally

1. The Signal Institutions Can’t Hide

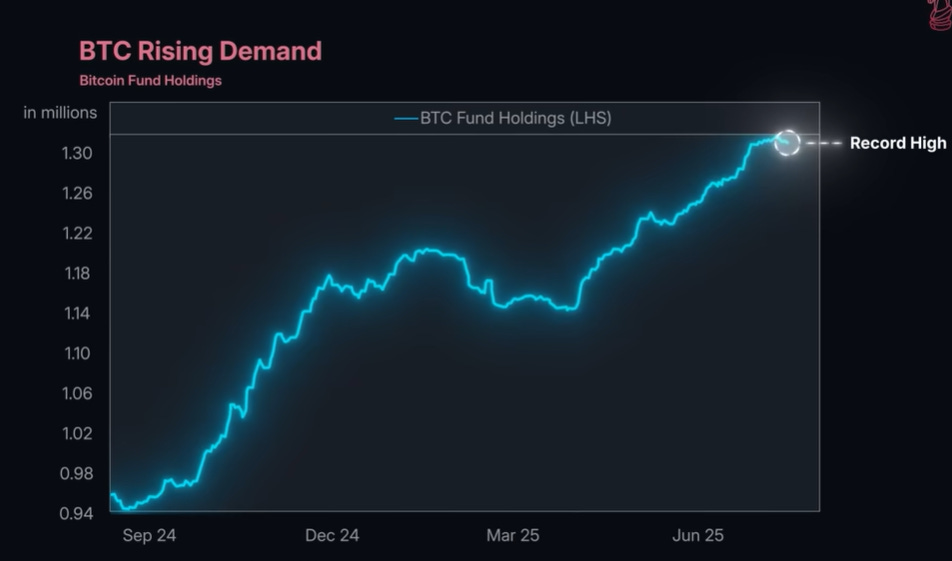

Bitcoin ETF holdings just hit an all-time high. This is more than just another headline — it’s a direct look into how the biggest money in the market is positioning itself.

Unlike retail traders, institutions tend to move in waves. Their buying and selling activity is slower, more deliberate, and far more impactful. ETF holdings give us one of the clearest real-time windows into this behavior.

Here’s how to read it:

When ETF holdings rise: Institutions are buying.

When ETF holdings fall: Institutions are selling.

Since April 2025, Bitcoin ETF holdings have climbed from 1.1 million BTC to 1.3 million BTC. That’s an increase of roughly 200,000 BTC in just three months. Nearly 20% of all Bitcoin held by ETFs today was bought in this short window.

2. Why This Move Matters for Price

Institutional accumulation is one of the most powerful forces in Bitcoin’s price action. We have multiple historical examples:

Sept to Dec 2024: ETF holdings rose sharply, and Bitcoin doubled in value.

Jan to Apr 2025: Holdings fell as institutions took profits, and Bitcoin corrected by around 30%.

The most recent accumulation wave (April to July 2025) pushed Bitcoin up 40%.

The correlation is not coincidental. Institutions aren’t chasing small moves. They are repositioning with a macro view, and when they shift heavily into Bitcoin, the price follows.

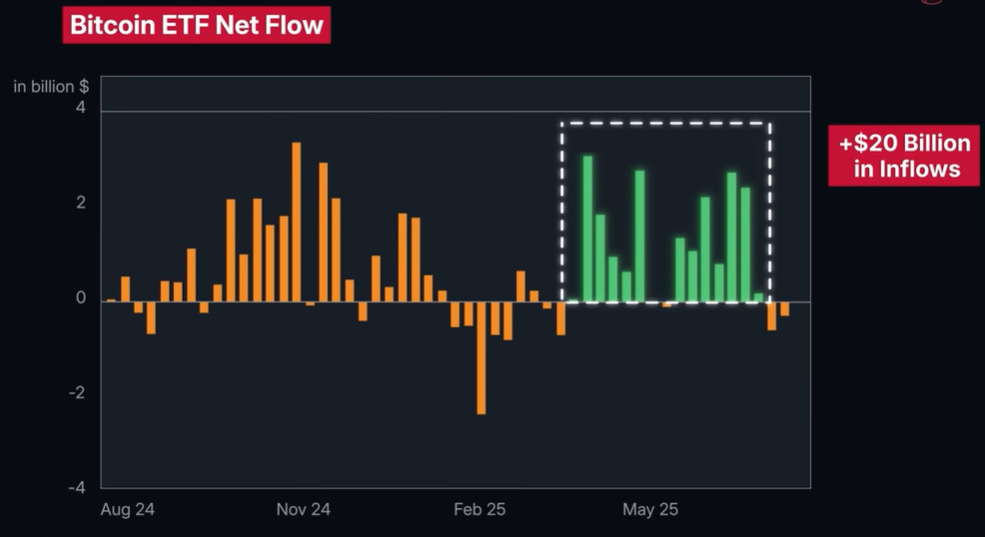

3. The Sudden $650M Outflow

Last week, we saw something that breaks the recent trend: a $650 million outflow from Bitcoin ETFs. This was the largest weekly withdrawal since April 2025.

One week doesn’t make a trend, but historically, sharp outflows often happen near turning points — either before a deeper pullback or as a short-term shakeout before a fresh leg higher.

Understanding why this happened is key to knowing which scenario we’re in.

4. Labor Market Shocks and Institutional Behavior

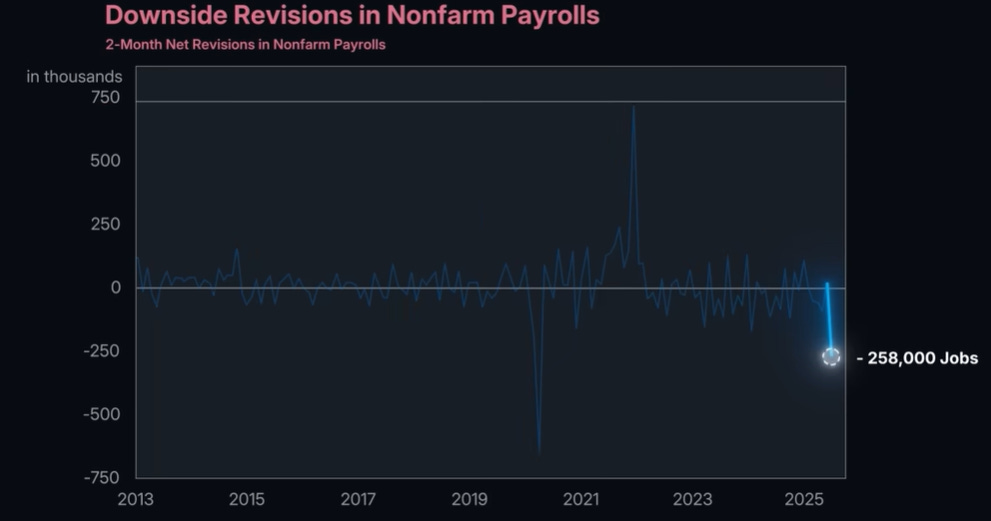

The outflow coincided with a major revision to US jobs data. The Labor Department had originally reported 144,000 jobs added in May and 147,000 in June. The revised numbers? Just 19,000 and 14,000.

That’s a downward revision of 258,000 jobs — one of the biggest two-month revisions since April 2020.

Why does this matter for Bitcoin?

Institutions are extremely sensitive to macro data. When the economy shows strong, stable growth, they allocate more to risk assets like Bitcoin. But when growth appears to be stalling, they scale back.

A weaker labor market increases fears of a slowdown, leading to capital flowing into safer assets.

5. Is This Recessionary or Just a Cooldown?

Initial jobless claims are not showing the kind of spike we saw in 2001 or 2008. This suggests the economy isn’t in a full-blown recession scenario yet. Instead, we’re seeing a cooling phase.

Why this is important: a moderation in the labor market often gives the Federal Reserve more room to ease monetary policy.

Easier monetary policy = looser financial conditions = better environment for Bitcoin.

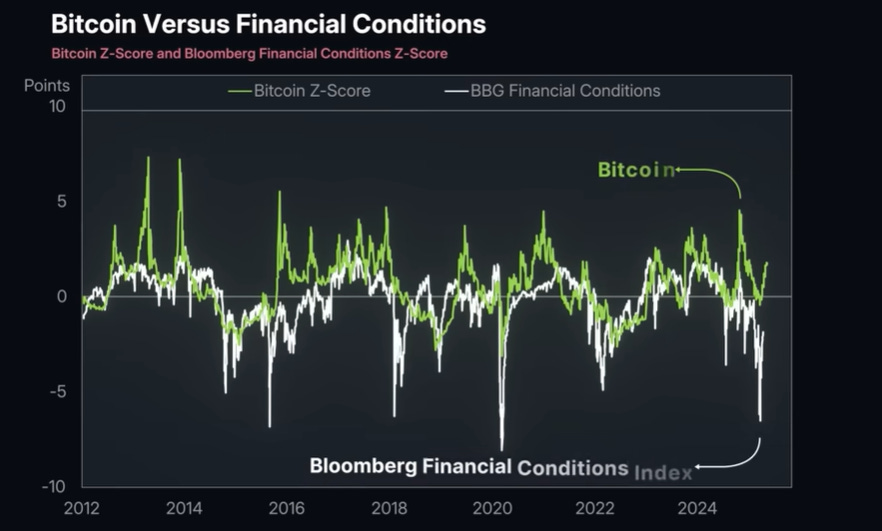

6. The Financial Conditions Factor

Financial conditions track how easy or hard it is for money to move through the economy. They’re influenced by interest rates, credit spreads, and liquidity.

When conditions are tightening, capital becomes scarce and risk assets suffer.

When conditions are easing, capital flows more freely and risk assets benefit.

Over the past three months:

Most major developed economies have been easing financial conditions.

The US has been easing twice as fast as the next largest economy.

History is clear on this relationship:

Loose conditions: Bitcoin thrives (2013, 2017, 2021).

Tight conditions: Bitcoin struggles (2014, 2018, 2022).

The first quarter of 2025 saw tight conditions and a 30% drop in Bitcoin. The recent easing helped fuel the rebound we’ve seen since.

7. The Trump Tariff Risk

One macro risk to watch: new tariff policies. If tariffs lead to another spike in inflation, the Fed could be forced to tighten conditions again. This would be bearish for Bitcoin.

For now, our base case is continued easing, but we have to keep this on the radar.

8. Global Liquidity — The Bigger Tailwind

Global liquidity — the amount of money flowing through the global financial system — is one of Bitcoin’s most important long-term drivers.

The year-over-year change in global money supply is now above 8%. This level of expansion has only happened three other times since 2015:

2016: Bitcoin +100% in 4 months

2017: Bitcoin +200% in 2 months

2020: Bitcoin +300% in 4 months

With Bitcoin now a multi-trillion-dollar asset, we may not see moves of that magnitude. But a rally to $150,000–$200,000 in the coming months fits the historical pattern.

9. Institutional Psychology Right Now

Institutions are looking at:

Record ETF holdings (bullish)

Slight labor market weakness (short-term caution)

Easing financial conditions (bullish)

Rising global liquidity (bullish)

This is a mixed picture, but with more bullish than bearish signals.

10. Our Positioning

At The Daily Dollar, we’re still holding our long position from $17,000 and are looking to scale up further if we see confirmation that last week’s outflow was just noise.

In the past year, our crypto trades have delivered:

+30% on Bitcoin

+36% on Solana

+83% on Ethereum

We guide our members through each move in this bull run, breaking down:

When to buy

When to take profits

How to size positions

If you want access to our real-time trade alerts, strategy breakdowns, and three weekly premium videos, you can join us using the link below.

The macro backdrop is setting up for what could be one of the most important phases of this Bitcoin cycle. Institutions are showing their hand — it’s up to us to read the cards.